The Perfect Storm: How Property Tax Shifts and Overcrowded Classrooms Are Squeezing Iron County Families

A recent audit by the Utah State Legislative Auditor General confirms what many Iron County homeowners already suspected: we are carrying an increasingly unfair share of the property tax burden while our schools struggle with overcrowded classrooms that would be illegal in many other states. It is time for our community to demand better from state lawmakers and work together on real solutions.

The numbers paint a troubling picture. According to the audit released this week, property tax burden has shifted dramatically toward homeowners across Utah. Davis County saw residential property owners go from paying 65% of total property taxes in 2015 to 74% in 2024. Weber County jumped from 62% to 70%, Utah County from 60% to 64%, and Salt Lake County from 56% to 58%. While Iron County was not specifically mentioned in the audit, our rapid growth and similar economic pressures suggest we face the same squeeze.

The audit describes this as a "perfect storm" caused by several factors: home valuations jumping in the early 2020s, state lawmakers freezing tax rates for five years until 2023, and reductions in values of centrally assessed properties like mines and utilities. The result? An extra $326 million in funding came from homeowners in fiscal year 2023 alone, nearly 60% more than originally expected.

But here in Iron County, we face an additional challenge that makes this burden even more unfair: our schools are bursting at the seams with class sizes that would shock families in other states.

The Classroom Crisis Nobody Talks About

I recently joined the Cedar Middle School Community Council and took on a role of Vice Chair. I figured it would help provide some introspect to see things through both lenses - as a tax-paying community member, and understand the needs of my sons' school. When I recently asked middle school faculty at CMS about the average class sizes at our first meeting, the answer was troubling: without batting an eye, our teacher representative said, "30 to 33 students per teacher and classroom". Let that sink in. In some states, this would be illegal.

Florida's constitution caps elementary classes at 18 students. Georgia limits kindergarten to 15 students and grades 1-3 to 17 students. Tennessee requires an average class size of 20 for grades K-3 with a maximum of 25. Even California, notorious for large classes, caps kindergarten at 31 and grades 1-3 at 30.

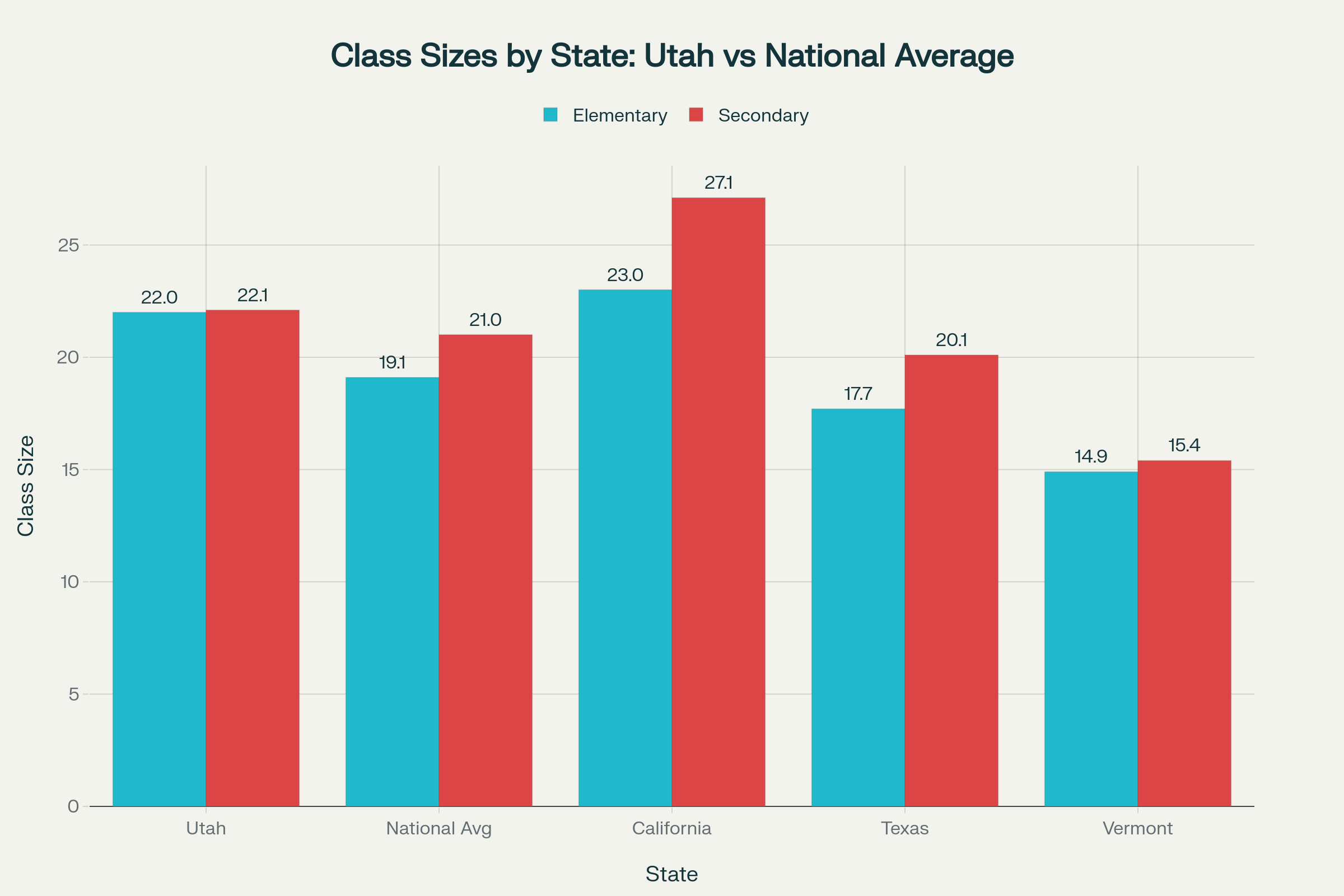

Utah's class sizes are among the worst in the nation. Our elementary classes average 22 students compared to the national average of 19.1. Our secondary classes average 22.1 students compared to the national average of 21. But the real problem is that Utah has no maximum class size laws to protect our children from overcrowded learning environments.

So when the district says they need to hire more teachers, and needs the funds to do it, I get it.

Why This Matters for Every Family

Overcrowded classrooms are not just an inconvenience. Research consistently shows that smaller class sizes lead to improved test scores, lower dropout rates, and higher graduation rates. The Student Teacher Achievement Ratio study in Tennessee found that reducing class sizes resulted in student achievement gains equivalent to about 3 additional months of schooling four years later.

When teachers have 30-33 students in a classroom, individual attention becomes nearly impossible. Behavioral problems increase. Learning suffers. The educators we spoke with are doing heroic work under impossible conditions, but they cannot perform miracles.

Meanwhile, we are asking these same families dealing with overcrowded schools to shoulder an ever-increasing share of property taxes. It is a double burden that is fundamentally unfair.

What Other States Are Doing Right

While Utah struggles with both funding and classroom overcrowding, other states have found better ways to manage growth and school funding without crushing taxpayers.

Texas has no state income tax and maintains reasonable class sizes through strategic use of sales taxes and other revenue sources. Their elementary classes average 17.7 students and secondary classes average 20.1 students.

Nebraska is actively working to eliminate property taxes for school funding entirely. Governor Jim Pillen wants to replace lost local funding by increasing sales tax collections, recognizing that "the state of Nebraska is supposed to educate children, not property taxpayers."

Michigan successfully shifted school funding away from property taxes in 1994 by raising the sales tax from 4% to 6% and implementing other revenue sources. This change initially increased spending and improved educational outcomes.

Colorado has established bipartisan commissions to study property tax reform and is exploring ways to provide targeted relief for families and small businesses while maintaining school funding.

Several states provide "circuit breaker" property tax relief programs that cap the amount homeowners pay as a percentage of their income. These programs recognize that property taxes can become an unfair burden on families with limited means.

What Iron County Needs From the Legislature

The Utah Legislature should immediately take action on several fronts:

First, establish maximum class size limits. Utah lawmakers have previously considered capping K-1 classes at 25 students. This is a good start, but we need comprehensive limits for all grade levels. States like Florida have proven this can be done without breaking budgets.

Second, diversify school funding sources. Utah relies too heavily on property taxes for school funding. The legislature should explore increasing sales and tourism taxes, implementing impact fees on new development, or creating dedicated education funding streams that do not fall on homeowners.

Third, implement circuit breaker relief. Utah already has a limited circuit breaker program for seniors, but it should be expanded to help all homeowners when property taxes exceed a reasonable percentage of their income.

Fourth, fix the truth-in-taxation process. The audit found confusion about virtual participation in tax hearings and problems with entities pursuing dramatic one-time increases instead of gradual adjustments. Clearer guidelines and automatic inflationary adjustments could help prevent shock tax increases. We saw this on full display with ICSD's Truth in Taxation and, as local taxpayers, got some temporary reprieve for reevaluation of practices.

Fifth, crack down on vacation rentals. The audit noted concerns that secondary homes and short-term rentals are not being properly designated, which shifts more burden to primary homeowners. Counties need better tools to verify primary residences and ensure vacation properties pay their fair share.

Solutions That Work for Growing Communities

Iron County's rapid growth is not going to slow down. Cedar City's population is expected to grow by over 35% in the next decade. We need proactive solutions that plan for this growth instead of reacting to it.

Impact fees should fully cover the infrastructure costs of new development, including schools. New residents should not force existing families to subsidize growth through higher property taxes.

Regional cooperation can help share costs. Other growing areas have created regional authorities for major infrastructure projects and school construction that spread costs more fairly.

State facility funding should prioritize rapidly growing districts like Iron County. The state should not expect local property taxpayers to bear the full cost of facilities needed to serve state-wide population shifts.

Teacher recruitment and retention programs should focus on high-growth areas. Smaller class sizes require more teachers, but Utah's teacher shortage makes this challenging. The state should provide targeted incentives for teachers willing to work in growing rural districts.

A Call to Action

This is not just a policy problem. It is a community challenge that requires all of us to work together.

Parents and taxpayers should attend school board meetings and county commission meetings. Make your voices heard about overcrowded classrooms and rising tax burdens. Our elected officials need to know that we are paying attention and we expect action.

School administrators should continue documenting the real costs of overcrowding and advocate forcefully at the state level. The data exists to make a compelling case for change, but it needs to be presented clearly and consistently.

County officials should work with the legislature to expand tools for property tax relief and improve the truth-in-taxation process. Iron County should not have to choose between adequate services and affordable taxes.

State legislators should visit Iron County schools and see firsthand what 30-33 students in a classroom looks like. They should talk to teachers, parents, and taxpayers about the real impact of current policies.

The "perfect storm" described in the audit is not an act of nature. It is the result of policy choices that can be changed. Other states have found better ways to fund education and manage growth. Utah can too.

But change will not happen unless we demand it. The time for excuses is over. Our children deserve better learning environments, and our families deserve fairer tax policies. Let us work together to make it happen.

We will be organizing letters to our local legislators suggesting avenues for common sense change and would love your participation to satisfy the needs of the community, our cities, the county, and the district. Physical signatures speak louder than a digital petition. I'll have more info on this soon!

The stakes are too high to accept the status quo. Our children's education and our community's future depend on getting this right.